Let's Get Real

Discover the reasons most Australian property investors fail to get the results they desire.

People invest in property for many different reasons; whether to leave a nest egg for their kids, retire early or travel - discovering your 'why' is key to achieving long-term success. Since establishing The Property Mentors four years ago after their own property investment success, authors Luke Harris and Matthew Bateman have helped thousands of Australians get on the road to achieving their financial freedom.

In their new book, Let's Get Real (Major Street Publishing $29.95), Luke and Matthew provide an easy to follow, jargon-free guide to successful property investment. They explain that if investors have the correct mindset, understand their motivation, define their goals and put together an A-Team of experts, they have all the tools to achieve their financial goals. Readers learn:

How to clarify your current financial and personal situation

Why mindset is critical to success

Common investment mistakes & how to avoid them

Why property is still the best way to create wealth, despite current market conditions

How to develop a wealth creation plan to achieve the lifestyle you desire

Filled with case studies, motivational quotes and tips, Let's Get Real is a call to action for those wanting to take control of their destiny and fulfil their life goals.

Luke Harris and Matthew Bateman combine four decades of experience in business, property and investing in this book. From humble beginnings, with little experience and nothing more than big dreams and a can-do attitude, Matt and Luke have both created and continue to grow significant wealth through property for clients and for themselves. Together they started The Property Mentors, a Melbourne-based business comprising an elite team of property professionals who educate, motivate and facilitate clients from all around Australia.

Let's Get Real

Major Street Publishing

Authors: Luke Harris and Matthew Bateman

ISBN: 9780648087533

RRP: $29.95

Interview with Luke Harris and Matthew Bateman

Question: What inspired you to write Let's Get Real?

Luke Harris and Matthew Bateman: For many years we had been asked by our clients to us to pen the tale of how we had managed to create the results we have been able to enjoy through our own property investing journey. So, just like we did prior to starting The Property Mentors Australia, when we finally decided to write Let's Get Real we started by asking the question "what is our reason for doing it"?

The answer was that we wanted to provide an invaluable resource for anyone seeking to take their own investment results to the next level. We did not want to add yet another textbook or "how-to" manual to the already clogged bookshelves, but rather we wanted to create a "why-to" manual and instead of focusing solely on the property we chose to focus heavily on you the investor. That is not to say that technical information, and high-quality property research is not important. Clearly it is, and we cover that off in other ways with our members, most notably via our live workshop trainings and one-on-one mentoring services. But equally, it is not the investment that chooses you but rather you the investor that chooses what they should, or should not, be investing in. Therefore, creating a thorough understanding of how you as an investor ticks; your education, your skills, your experience, your risk:reward profile, your networks, your resources and the decision-making processes you go through are even more paramount to your success than simply having an understanding of property fundamentals and due-diligence.

Many investors, will find this challenging to hear. That ultimately, they are responsible for all the success (or lack of it) that they will enjoy in their lifetime.

Some investors will not have the emotional honesty or courage to take that long hard look at themselves in the mirror and identify both their inherent strengths but also their weaknesses. But Let's Get Real is a book that asks the reader to do exactly that. To take that inwards looking journey, and to learn the steps, tools and processes to be able to get to the other side and enjoy all of the abundance that life has to offer!

Question: How can we clarify our personal finance situation?

Luke Harris and Matthew Bateman: As the title suggests the first step in clarifying where we are and perhaps more importantly where we want to be financially is to Get Real with how we got to where we are today. That is, to date all of the success (or lack of it) that we are currently enjoying financially can be traced back to the thoughts and beliefs that we hold about ourselves and our abilities as investors, as well as the subsequent actions (or inactions) that we have made as investors. We are the sum total then of all those decisions, both small and large, that we have made in our lives so far. And we will continue to generate results based on all the decisions we will make into the future. So, knowing that, does it not make sense that we should learn to understand how we tick, and how we make decisions when it comes to our finances?

You see it is not until we Get Real with ourselves that we will be able to ask these two powerful questions for ourselves moving forwards;

Are the decisions I have been making to this point ones that I want to continue to make moving forwards

and is this decision I am about to make going to help me get closer to, or further away from, the financial goals I have for my life?

Question: Can you share with us a common property investment mistake and how to fix it?

Luke Harris and Matthew Bateman: Perhaps the most common investment mistakes we see on a consistent basis is from investors who are going and spending money in the market place without;

The requisite amount of knowledge or education to make that investment and

Without having a clear plan as to what they are even trying to achieve in the first place.

I will be the first person to admit that in my earlier investment career I lost both time and money chasing a raft of poor investments. And to be really clear it was not that the investments themselves were to blame but rather my lack of the right education and my own lack of a clear plan that allowed me to fall victim to those investment choices.

It took a number of years and hundreds of thousands of dollars before I learnt a few valuable lessons;

Money will flow from the uneducated to the educated &

Money will flow from those with no clear plan for it to those that do.

Question: So, how does one develop the right education and the ability to create a clearly defined wealth plan?

Luke Harris and Matthew Bateman: Well to start with it is not a skill that comes naturally to most people, and not one that is commonly taught at home, school or in the workplace. The systems, tools, and processes that we work through with our members are the result of decades of personal experience and the advantages of having worked with literally thousands of investors over the years. It takes both time and energy to work through these steps, but the rewards on the other side in our opinion more than compensate anyone willing to put up their hand and ask for the help required to work through this process.

Question: In short, why should we be investing in property?

Luke Harris and Matthew Bateman: Well the simple answer is we don't know if you should be investing in property at all. Well not at least until we have had the opportunity to take a deep dive into your personal situation, assessed your risk:reward profile, and take a look at the plans that you have for your life and your finances.

So, without knowing that information all we can do here is share 5 compelling reasons why we have chosen property as our primary investment focus;

Property Has An Essential Underlying Demand. So, whilst there are luxury properties out there, property is certainly not a luxury for most people but rather an essential need for survival. Like food, air and water the underlying nature of property means that it is something that will always be in strong demand. So, unlike some other investment options whose success may come and go with the seasons, property will be a perennial asset class.

Property Has A Strong Track Record of Growth & Stability Of course, all financial advisers will tell you that historical performance is no guarantee of future performance, and this is of course true. However, a proven history of house price stability has even led to phrases like "as safe as houses" to become common vernacular. House prices, like many other assets are cyclical, and are further driven by imbalances in supply and demand, and can go up, down or sideways in the short term. However, in the longer term, and unless the governments create economic policies that are the exact polar opposite of those that have largely been in operation since federation; it is likely that over the longer-term house prices will move up. In fact, just like the cost of milk, bread and most other staples will become more expensive over time, the question is probably not whether house prices will go up, but rather how much above inflation will house prices rise over time compared to all other asset classes.

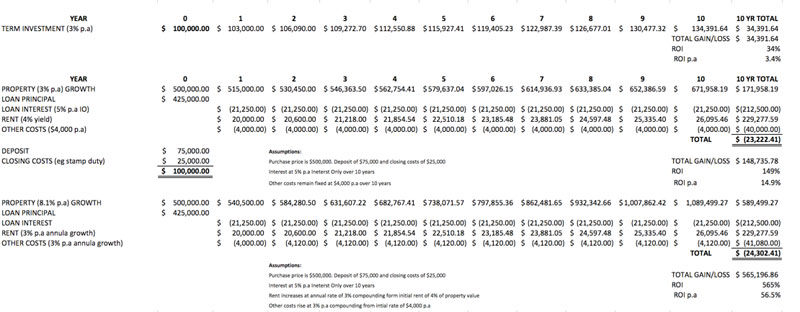

The Banks Love Property Infamous bank robber Willie Sutton was reportedly asked by a journalist "Mr Sutton, why do you rob banks" to which he allegedly replied "Because that is where the money is!". The combined value of the Australian Residential property markets sits at around $7.5T as at March 2018 according to Corelogic data. So, it may come as no surprise that despite their recent roasting at the Royal Commission and by the Australian Prudential Regulatory Authority (APRA) the Big 4 Banks in Australia still represent the biggest investors in the Australian property markets indirectly via their mortgage books. So, despite tighter lending conditions over recent times, banks are still open to expanding their loan books and are willing to put their own money on the line in lending to qualified borrowers seeking to invest in property. By being able to effectively partner with lenders, property investors are able to leverage the amount of property assets that they can control. For example, imagine as an investor you had $100,000 available to invest. You could invest that into for example a term investment, or government bond, and achieve yields of say 3% p.a in this market. Imagine, that you reinvested all the interest earned for 10 years. Your total return on this type of investment would be close to $35,000 in interest over the decade. Or, you may have chosen to invest that $100,000 into a property asset valued at say $500,000 by borrowing the bulk of the monies required and using the assumptions that the property asset also only grows at 3% and that we can achieve an interest rate of 5% p.a (Interest Only) and rental return is 4% p.a and other costs (eg rates and maintenance) remain constant at $4,000 p.a your total return would be closer to $150,000.

Of course, if your property asset grew at the average 8.1% p.a figure that the Bank of International Settlements (B.I.S). calculated has occurred in Australia's residential property market since the 1960's then the results could be even more impressive thanks to the ability to leverage the asset.

The Government Depends on Property Revenues To Operate

Did you know that approximately half of all State Government & Local Government revenues come from property related fees and taxes. The Australian Bureau of Statistics (ABS) has recently released the latest taxation statistics data for the 2015-16 financial year. Which shows that $49.567 billion in property taxes were collected nationally.

For example, the latest Victorian State Budget expects to raise more than $27 billion in stamp duty, and more than $11 billion in land tax, over the next four years.

So, do you know of any level of Government that requires less income into the future in order to continue to provide the essential infrastructure and services for all residents? So how does this apply to the future of property prices? Well, in order for State & Local Governments to maintain or continue to increase their revenue base, it is vital that property prices continue to either stay high, or go up even further over time. Now, we are not suggesting that there is a deliberate conspiracy at play here, but there is certainly at least a vested interest in all levels of Governments keeping the supply Vs demand imbalance in play here. Governments obviously have their fingers firmly on the planning policy levers and could if they wanted to swamp the market with the release of more supply via the wholesale approvals of new stock. Similarly, they could choose to decrease the cost, compliance and red-tape surrounding the planning process. However, in doing so that would likely lead to property price reductions and therefore lowered Government revenues which may be add odds with their requirement to fund all the essential infrastructure and services needed to support growing communities.

We Can Add Value To Property

What differentiates investors from speculators? Well for ours it comes down to 3 key things:

Do you know your risk upfront?

Do you know your returns upfront?

Do you know your time frames upfront?

For a lot of "investors" however, they will generally not be able to have any level of confidence on all 3 of these ingredients for success upfront and therefore will carry varying degrees of speculation surrounding their investment decisions.

One of the cool things about property investing is that there are many different ways to make money from property.

Buy and hold, renovation for profit, flipping, low-balling, subdivision, and development to name but a few.

Now, one main of advantage of property is that it may be possible to apply your own skill, experience, & resources to add value to the asset. This may allow you to know with some level of confidence that you are able to control at least some part of the outcome of your investments and decrease the speculative nature of investing.

Find out more at www.thepropertymentors.com.au

Let's Get Real

Major Street Publishing

Authors: Luke Harris and Matthew Bateman

ISBN: 9780648087533

RRP: $29.95

MORE